How Medicare Graham can Save You Time, Stress, and Money.

How Medicare Graham can Save You Time, Stress, and Money.

Blog Article

The Facts About Medicare Graham Revealed

Table of ContentsSee This Report on Medicare GrahamThe Main Principles Of Medicare Graham Facts About Medicare Graham RevealedAbout Medicare GrahamThings about Medicare Graham9 Easy Facts About Medicare Graham ShownUnknown Facts About Medicare GrahamMedicare Graham - An Overview

In 2024, this threshold was established at $5,030. Once you and your plan spend that quantity on Component D drugs, you have gone into the donut opening and will pay 25% for medicines moving forward. When your out-of-pocket costs get to the 2nd limit of $8,000 in 2024, you are out of the donut opening, and "disastrous protection" starts.In 2025, the donut opening will certainly be greatly removed in support of a $2,000 limitation on out-of-pocket Part D medicine costs. Once you hit that limit, you'll pay nothing else out of pocket for the year.

While Medicare Part C functions as an alternative to your original Medicare strategy, Medigap functions with each other with Components A and B and helps fill out any type of insurance coverage gaps. There are a few important points to recognize regarding Medigap. Initially, you should have Medicare Components A and B before purchasing a Medigap plan, as it is a supplement to Medicare and not a stand-alone policy.

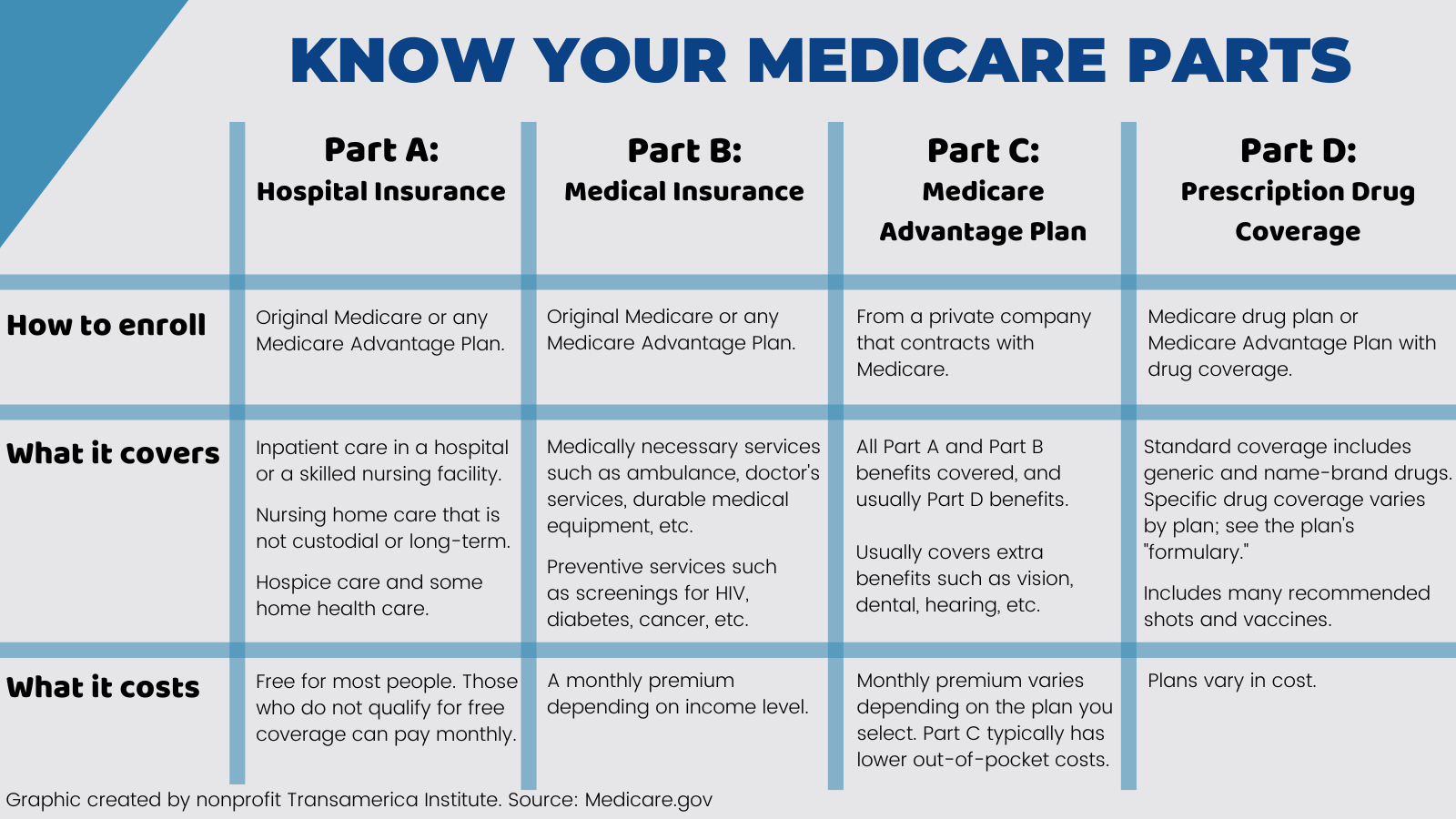

Medicare has actually progressed for many years and currently has four components. If you're age 65 or older and get Social Safety, you'll automatically be signed up partially A, which covers hospitalization costs. Components B (outpatient solutions) and D (prescription drug advantages) are voluntary, though under specific circumstances you may be instantly enrolled in either or both of these too.

The smart Trick of Medicare Graham That Nobody is Talking About

This post discusses the kinds of Medicare intends available and their protection. It also uses advice for individuals that take care of relative with handicaps or health conditions and desire to manage their Medicare events. Medicare consists of 4 parts.Medicare Part A covers inpatient medical facility care. It also consists of hospice treatment, knowledgeable nursing center care, and home health care when an individual fulfills certain standards. Regular monthly premiums for those that need to.

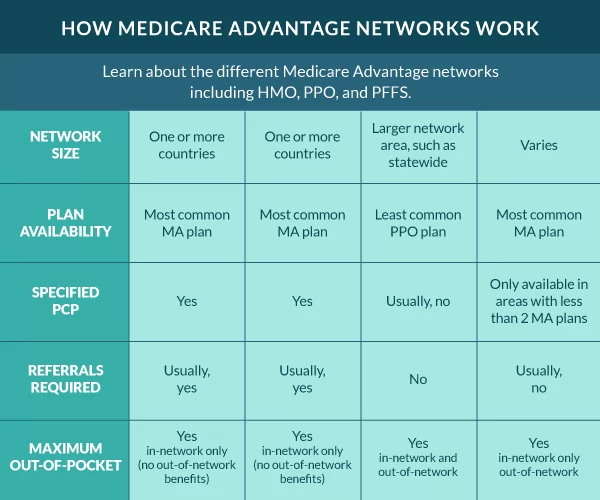

buy Part A are either$285 or$ 518, depending on the amount of years they or their partner have paid Medicare taxes. This optional coverage requires a month-to-month costs. Medicare Part B covers medically essential solutions such as outpatient doctor gos to, diagnostic solutions , and precautionary services. Exclusive insurance firms market and provide these policies, yet Medicare has to accept any type of Medicare Benefit strategy prior to insurance firms can market it. These strategies offer the exact same protection as parts A and B, but numerous additionally consist of prescription medicine coverage. Monthly premiums for Medicare Benefit prepares often tend to depend on the location and the plan an individual picks. A Part D strategy's protection relies on its price, medication formulary, and the insurance coverage copyright. Medicare does not.

All About Medicare Graham

typically cover 100 %of medical prices, and the majority of strategies need a person to meet an insurance deductible before Medicare pays for clinical solutions. Part D typically has an income-adjusted premium, with greater costs for those in greater income brackets. This puts on both in-network and out-of-network healthcare experts. Out-of-network

Get This Report about Medicare Graham

care incurs additional costs. For this kind of plan, managers establish what the insurance provider pays for medical professional and healthcare facility protection and what the strategy owner should pay. A person does not need to choose a main treatment doctor or get a recommendation to see a professional.

Medigap is a single-user plan, so partners have to acquire their own coverage. The expenses and benefits of various Medigap plans depend on the insurance coverage business. When it comes to valuing Medigap plans, insurance policy suppliers may make use of one of numerous approaches: Premiums coincide no matter age. When an individual starts the policy, the insurance policy company factors their age right into view it the premium.

Medicare Graham Things To Know Before You Buy

The cost of Medigap intends varies by state. As kept in mind, prices are reduced when a person gets a plan as soon as they get to the age of Medicare qualification.

Those with a Medicare Benefit strategy are ineligible for Medigap insurance. The time may come when a Medicare plan owner can no more make their own choices for reasons of mental or physical wellness. Before that time, the person needs to assign a trusted person to serve as their power of lawyer.

The individual with power of attorney can pay costs, data taxes, gather Social Security benefits, and pick or alter medical care plans on part of the insured individual.

The 7-Minute Rule for Medicare Graham

A launch form informs Medicare that the insured individual permits the called person or group to access their clinical details. Caregiving is a demanding task, and caretakers frequently invest much of their time satisfying the demands of the person they are looking after. Some programs are offered to give (Medicare) monetary aid to caretakers.

army veterans or people on Medicaid, other choices are readily available. Every state, in addition to the Area of Columbia, has programs that permit certifying Medicaid recipients to manage their long-lasting care. Relying on the private state's guidelines, this might include employing about supply treatment. Considering that each state's guidelines vary, those looking for caregiving repayment need to consider their state's needs.

How Medicare Graham can Save You Time, Stress, and Money.

The insurance firm bases the initial premium on the individual's current age, yet premiums increase as time passes. The rate of Medigap intends differs by state. As kept in mind, costs are lower when a person purchases a policy as quickly as they reach the age of Medicare eligibility. Individual insurance provider may also provide discount rates.

Those with a Medicare Advantage plan are disqualified for Medigap insurance. The time might come when a Medicare strategy owner can no more make their own choices for factors of mental or physical wellness. Prior to that time, the person ought to designate a trusted person to work as their power of attorney.

The Greatest Guide To Medicare Graham

The individual with power of attorney can pay costs, file tax obligations, collect Social Safety advantages, and select or alter medical care plans on part of the guaranteed individual.

Caregiving is a demanding task, and caregivers usually spend much of their time satisfying the demands of the individual they are caring for.

Report this page